What They Don't Tell You About Getting Funded, and the Plan That Changed Everything:

The system didn’t make it easy. But the right plan opened doors. Learn how I funded a landmark project—and how you can fund yours too.

This post contains affiliate links. I only recommend what I use and trust. Full disclosure: I use LivePlan in my own work and with clients. If you subscribe through the links in this post, I may earn a commission—at no extra cost to you.

I think every woman has had a moment at a wedding when she’s looked around at the flurry of details and thought: I could do this. Start a business. Launch a venue. Become the person who makes the magic happen.

For me, that moment wasn’t just a fleeting thought. It marked the beginning of a journey that led to one of the largest small business loans awarded to a woman-owned startup at the time, along with more than $500,000 in grants.

But this story goes far beyond SBA approvals. It’s about how to fund a vision, even when the system says no.

Because having a good idea isn’t enough. Not when you’re speaking to people who don’t care about fairy lights or floral arrangements.

You have to learn the language of money.

The Problem: A brilliant vision isn't enough to get funded. You must translate that vision into a financial story that lenders, grant committees, or investors trust.

The Old Way: The only option used to be hiring expensive consultants. I spent over $17,000 on an expert to get my plan right.

The Modern Way: Software like LivePlan now acts as your expert translator, weaving your story and financials together professionally for a fraction of the cost.

The Real Goal: A business plan isn't just a document for a loan; it's a living roadmap for you—to make decisions, navigate crises, and build a resilient business.

My "Aha" Moment: From Frustrated Bride to Aspiring Founder

It all started at my own wedding. The venue was a historic gem, but they had a list of pre-approved vendors, and one of them quoted us a price that was nearly ten times higher than his peers. His reason? A Hollywood celebrity had recently used his services at the same venue.

That conversation was the spark. It was absurd. It made me question everything. Why should a beautiful, luxurious wedding be out of reach for hardworking people? Who made these rules?

Right then, the vision for my own venue was born.

And if you're an entrepreneur, you know the feeling.

It’s not just an idea in your head; you feel it in your gut, on a cellular level.

It’s a tugging from your spirit that doesn’t go away.

You know that if you don’t bring it to life, it will haunt you.

The $17,000 Wake-Up Call: Learning to Speak “Banker”

Having the vision was the easy part. Getting it funded was a different story.

I spent hours on bookstore floors, devouring every book on business plans. I learned about the "big three" financial statements—the Balance Sheet, P&L, and Cash Flow statement. But here’s the real deal: knowing what they are and knowing how to make them sing are two different things.

My passion was in the story, the colors, the experience. But investors and bankers don't speak that language. They speak in projections, ratios, and risk mitigation. They need a financial story that proves you’re a good bet.

The hardest part of writing my business plan wasn’t the narrative or the numbers. It was weaving them together into a single, compelling story that bankers and investors could understand and believe in.

I realized I needed a translator. I ended up hiring a brilliant consulting firm. A winning team that cost me over $17,000. Together, we built the plan that would ultimately win. But as I wrote that check, I knew there had to be a better way for the next person with a big dream.

Back then, every lender I pitched, including the SBA, said yes.

But I've thought often about what would've happened if they hadn't.

This plan would’ve still mattered. The clarity it created helped me pitch confidently, win grants, and pivot in a crisis. That’s what makes it powerful. It works, even when the path to funding isn’t straightforward.

The Modern Translator: How LivePlan Bridges the Gap

Today, that better way exists. The software I used back then to get my thoughts organized has evolved into an foundational tool called LivePlan.

It’s the expert translator I wish I'd had from day one.

LivePlan doesn’t just give you a template; it guides you through the process of building a professional, fundable plan. It makes you fluent in "banker" by doing the heavy lifting.

- It Weaves Your Story for You: LivePlan’s step-by-step process intelligently connects your vision (the narrative) with your numbers (the financials), so they support each other seamlessly.

- It Demystifies the Financials: You don't need an accounting degree. It helps you create clear forecasts and financial reports, and even lets you compare your projections to real-world industry benchmarks.

- It Creates the Perfect Pitch for Any Audience: This is crucial. A traditional bank needs a full, detailed plan. A venture capitalist might just want a sleek, one-page pitch deck. LivePlan lets you create all of them from the same core data, so you’re always ready.

Ready to see how a professional plan comes together? LivePlan gives you the structure and tools to build a plan that gets results. It’s how I turned vision into reality, and how I help others do the same.

Explore LivePlan's Features Here.

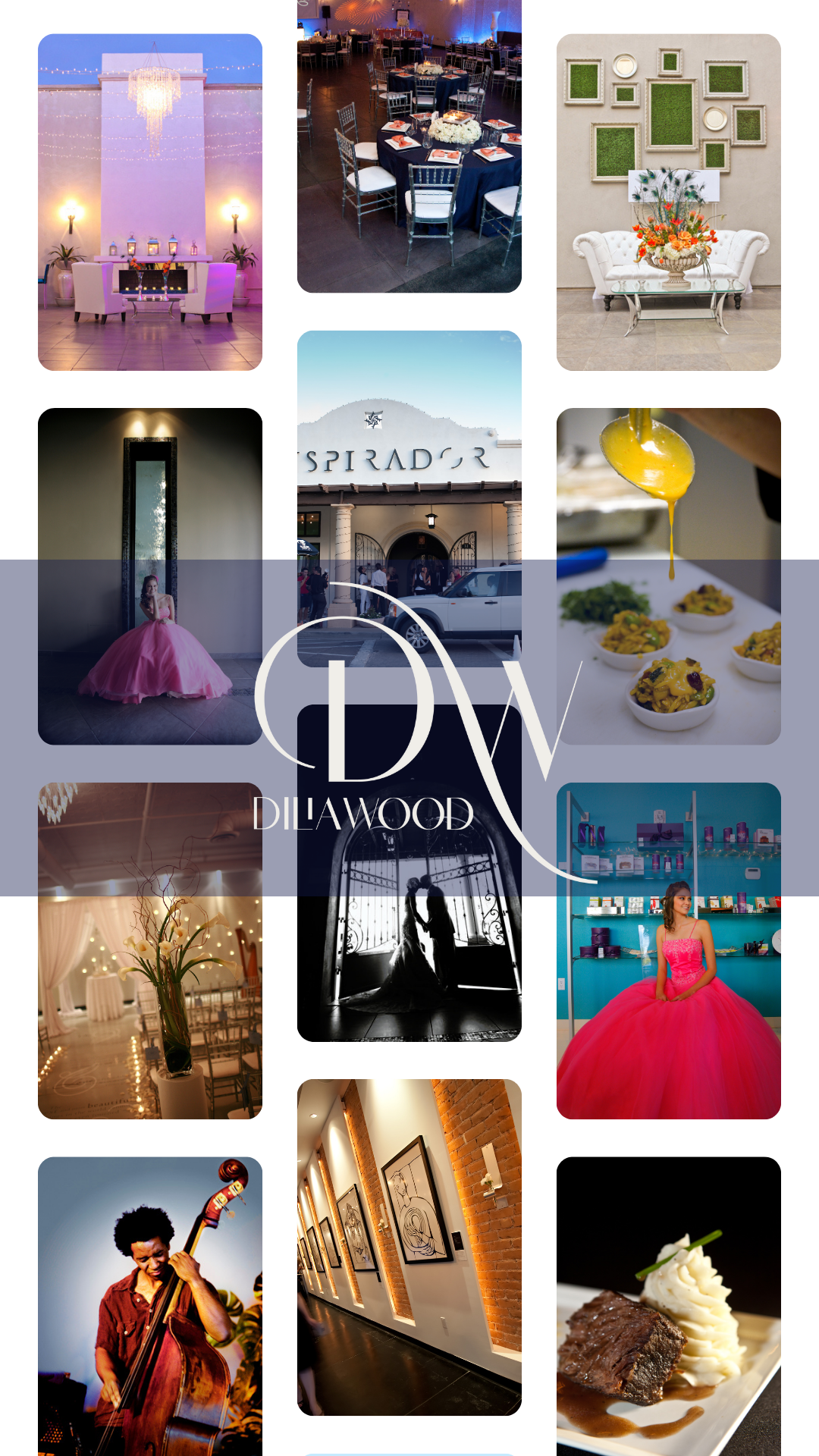

The Proof Is in the Project: Turning a Plan into a Landmark

That business plan did more than just get me a "yes." It gave me options. It was the foundation for everything that came next.

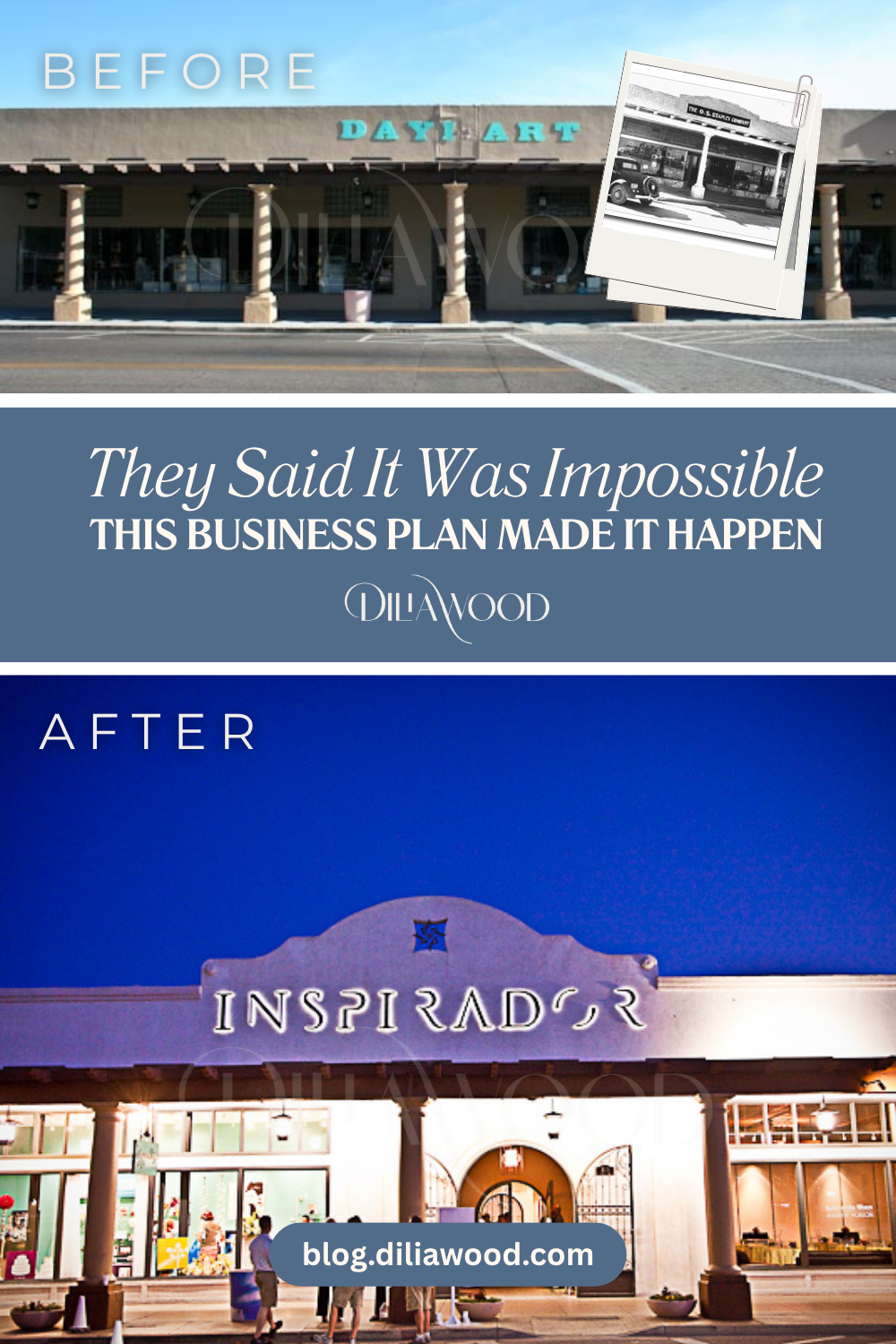

The plan was for a highly complex, multi-faceted project. It wasn't just an idea; it was a landmark transformation.

Property Type: Landmark Historic Building

(O.S. Stapley Hardware Company, Built 1916)

Size: 12,000 square feet

Project Name: Inspirador

Location: 63 East Boston Street, Chandler, Arizona

(Historic Downtown District)

Project Scope: A multi-million dollar adaptive re-use, historic preservation, and urban redevelopment project.

Developer: Dilia Wood, Founder & CEO

Key Outcome: Secured a multi-million dollar small business loan and $500k+ in grants, leading to a thriving community hub that successfully navigated two major economic recessions.

This plan was my roadmap.

When the 2008 financial crisis hit, I turned to my plan to re-evaluate our models. In 2020, I had a new plan and did it again.

It’s the most valuable tool I have for strategic clarity.

Start Here: Your First 3 Moves

I use LivePlan with my own consulting clients, and I always give them this advice to get started. Trust me on this.

- Start with the Pitch Page. Before you write pages and pages, complete LivePlan’s one-page Pitch. It forces you to be incredibly clear and concise. This will become the backbone of your entire plan.

- Use the Industry Benchmarks. When you get to the financial section, don't just guess. Use the benchmarking feature to see how your numbers compare to real businesses in your industry. This is how you ground your dream in reality.

- Obsess Over Your Market Analysis. Before you do anything else, deeply understand your customer and your competition. Answering these questions first will make every other section of your plan ten times stronger.

Your Vision Deserves a Rock-Solid Plan

A business plan isn’t something you write for the bank. It is a strategic roadmap you create for yourself. It helps you make smart decisions, build credibility, and move forward with clarity.

Your vision is worth more than guesswork or generic templates. I once paid over $17,000 for expert guidance because I knew the right plan could open doors. Today, the tool I use with clients does that work at a fraction of the cost.

I am not just recommending LivePlan. I use it in my own ventures, and I have guided clients through it when the stakes were real. Especially now, with traditional funding paths shifting, this tool helps you create a plan that earns trust. Whether you are applying for a grant, pitching investors, or working with a bank that will not say yes easily, LivePlan gives you a professional edge.

Before I present any idea to a funder, I test it here first. Every time.

Click Here to Build Your Breakthrough Business Plan with LivePlan Today

Affiliate Disclosure: I believe in this tool because I live by its principles. If you choose to subscribe to LivePlan through the links on this page, I may receive a commission at no extra cost to you. I only recommend what I use and trust.

Want the Full Story? Go behind the scenes of a multi-million dollar adaptive reuse project that transformed a historic hardware store into a thriving community hub. This case study reveals the full timeline, business model, funding strategy, and architectural evolution—led by solopreneur and developer Dilia Wood.

From financial blueprints to design breakthroughs, see how one woman brought a historic property back to life without investors, and how her original plan still sustains the business today. [Case Study Here]. (members-only access)

Frequently Asked Questions

1. Do I need a business plan if I'm not looking for a loan? Yes. 100%. Forget the lenders for a second. A business plan is your personal roadmap for making smart decisions, navigating challenges, and planning for growth. It’s the most powerful tool for clarity you can have.

2. What's the hardest part of writing a business plan? For most people, it's creating realistic financial projections and seamlessly connecting them to their narrative. You have to prove your great idea is also a viable business. This is the exact problem LivePlan solves by guiding you through the process.

3. Is LivePlan just for startups? Not at all. I used my plan to navigate two recessions long after I was established. It’s a tool for starting, growing, and pivoting. Whether you’re seeking funding, planning a new product line, or just need strategic focus, it’s designed to help.

4. Is LivePlan expensive? It's all about value. Compared to the alternative—hiring a business plan consultant, which can cost thousands (I spent over $17,000)—LivePlan is an incredibly cost-effective investment. It provides the structure and tools of an expert for a tiny fraction of the price. Plus, they offer a 35-day money-back guarantee, so you can ensure it's the right fit for you completely risk-free.

Still holding onto a big idea?

You don’t need a perfect plan to begin, but you do need to stop dreaming alone.

I write for women who feel the pull to build something of their own, even if they’re still figuring it out.

Join my private list for honest stories, practical tools, and the kind of support I wish I had when I started.